At SMPTE’s annual technical conference (ATC) in Los Angeles last week, the keynote address was presented by Anthony Wood, founder and president of Roku and an early pioneer of DVR technology. His talk was called “The future of TV will be streamed.” That’s right! To kickoff the SMPTE ATC this year, the founder of Roku stood up in front of an audience full of television engineers to announce that traditional broadcast will be killed by over-the-top (OTT) streaming.

His argument was simple. The internet has completely disrupted many other entrenched industries including newspapers, magazines, recorded music, as well as retail commerce in general. Traditional broadcast television is next on the list, on the fast track to obsolescence, displaced by streaming services like Netflix and Hulu on streaming devices like Roku and Apple TV.

As with any good keynote address, Mr. Wood’s presentation sparked lively debate. But was it over the top? (Bad pun, I know!)

(source: www.roku.com)

Fundamentally I agree with Mr. Wood’s premise. I believe the future of TV will be streamed.

- Media consumption is all about convenience – viewing what I want, where I want, when I want, on whatever platform I want.

- Bandwidth and content will eventually be decoupled. For decades, cable and satellite customers have been forced to purchase bundles of content and bandwidth. But over time, consumers will have the choice to buy bandwidth (home and mobile) from one set of vendors, and rent content separately from other vendors.

- Studies show that consumers anticipate that they will “cut the cord” when a superior streaming solution becomes available. In a recent consumer study by Deloitte, 64% of consumers agreed with the following statement: “If I could select my own television content and have it streamed to a digital device…I would give up my cable or satellite subscription.”

- Sales of physical media (DVD, Blu-ray) are dropping precipitously.

That said, the transition will take a long time.

- Although content is king, media is heavy. So content owners (and consumption device vendors like Roku) still need cable, telco and satellite service providers for media distribution. Bandwidth vendors will continue to extract a big chunk of revenue for media delivery services.

- Not all content is available via streaming services. For example, live local news and live sports remain the exclusive domain of traditional broadcast. And premium content vendors like HBO typically require customers to have a current cable or satellite subscription in order to access their content via streaming. No wonder the vast majority of Roku owners also have a cable or satellite subscription, according to the Next TV Summit.

- Consumers are surprisingly happy with cable. According to a recent Deloitte study, consumers are overwhelmingly satisfied with paid TV services when it comes to programming availability, user experience and customer service. Only a minority (10%-32%, depending on age demographic) believe they can get all the TV content they want through internet and streaming sources.

- Cord cutting is proceeding slowly. In 2011, there were more than 100 million cable and satellite subscribers in the U.S. but only 1.5 million homes terminated their TV service, according to Nielsen.

- While internet streaming services like Netflix and Hulu are growing quickly, sales of physical discs are still three times larger. According to DEG, sales of physical discs amounted to $1.67 billion in Q3 2012, while subscription streaming services were $579.2 million for the same period.

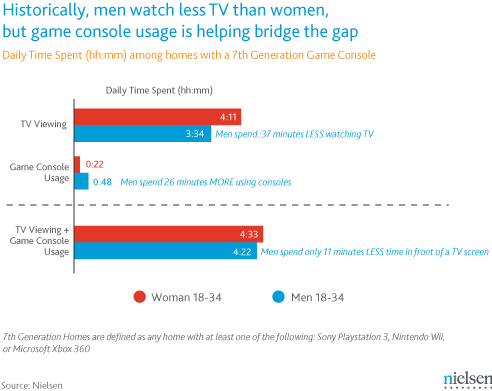

In this way, Mr. Wood’s keynote highlighted the broadcast industry’s current state of cognitive dissonance. Television is alive and well as we know it. Consumers are watching more TV than ever before. But given explosive growth in OTT streaming, the disruption is clearly underway, if moving slowly.